The Business of Neurocritical Care: Understanding Physician Benefits

Published on: September 22, 2024

In general, when most neurointensivists look into selecting a job, we focus on the job requirements (schedule, call, support from APPs and trainees, title, etc.), income (base salary, wRVU bonus structure, quality bonus, etc.), and work environment (collegiality of team members, geographic location, academic affiliation, type of medical center, etc.). We rarely put much thought into the physician benefits (PBs). This is in part due to the fact that PBs are rarely emphasized by employers in the recruitment process, and in many cases we are only made aware of them after signing an offer letter. However, the level of PBs can vastly impact one’s total compensation package (TCP).

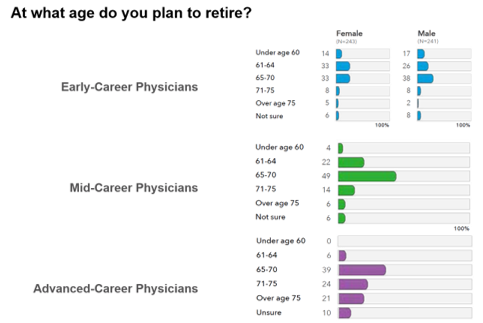

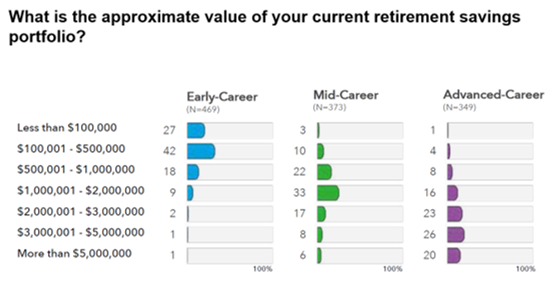

Although no such report exists for neurointensivists, the 2021 American College of Physicians: Physician’s Preparedness Report highlighted the variability in financial planning amongst internists, hospitalists, and internal medicine specialties.

Here we will discuss the retirement benefits component of PBs as they pertain to one’s TCP. The details below apply to most centers but there are variations from one employer to another.

Retirement Benefits

401(a)/401(k)

Basics: The 401(a) is an employer-sponsored retirement plan similar to a 401(k). The key difference is that a 401(a) is limited to government agencies (e.g., state and county hospitals), non-profit organizations, and educational institutions (e.g., university medical centers), whereas 401(k)s are associated with private companies. The employer sets the eligibility requirements but makes participation mandatory in an attempt to help their employees save money for retirement and reduce their tax burden [1]. 401(a) plans are often referred to as “free money” as they do not require any contribution from the employee. Depending on the situation, some employees are allowed to make additional contributions to their 401(a) plan at which point most physicians will be saving between $0.30 to $0.40 on every dollar that they are contributing. In other words, by making a contribution you will already be receiving a 30-40% up front return (money that would have gone to taxes had you not contributed). The investment options are set by the employer but usually include stocks, mutual funds, and bonds from large investment firms. The employer may also set a vesting period (a minimum duration of employment required to keep the funds).

Tax advantages: The employer contributes pre-tax dollars, which unlike personally-held brokerage accounts, means that you will not be taxed on interest, dividends, or capital gains on a yearly basis. You will pay regular income tax on qualified withdrawals which may begin as early as age 59 ½ but can be postponed until age 70. Most physicians begin qualified withdrawals once they retire, at which point they are in a comparatively low-income tax bracket as they are no longer earning a physician’s salary and thus will have a lower tax burden on the portion that is withdrawn annually. If for some reason the money is withdrawn prior to age 59 ½, there is a 10% penalty plus income tax based on your current tax bracket at the time of withdrawal. For 2024, the annual contribution limit is $69,000.

403(b)

Basics: The 403(b) is a tax-favored retirement plan for employees of public schools, 501(c)(3) tax-exempt organizations, cooperative hospital organizations, or religious institutions. 501(c)(3) tax-exempt hospitals, often referred to as charity hospitals, are not-for-profit hospitals who meet a list of federal criteria and are exempt of federal tax. Cooperative hospital organizations, like credit unions, are co-owned and operated by their members for mutual benefit [2]. Most health systems offer an employer match (another source of “free money”) for a fraction of the maximum allowed annual contribution ($23,000 for those under age 50 and $30,500 for those over 50). The same rules as in 401(a) plans apply for withdrawals.

Tax advantages: The tax advantages of the 403(b) can be thought of in two buckets. The first centers on “free money” from an employer match (if offered). For example, if an employer offers a 5% match that means that you would take 5% of your salary (pre-tax) and contribute it to your 403(b) plan and the employer would also add 5%. Because you will not pay taxes on the 5% that you contribute, your total reduction in your take-home salary will only be reduced by 3-3.5% (based on a 30-40% total annual tax burden) as opposed to 5%, yielding an up-front return of 1.5-2% on this component. This, coupled with the employer contribution of 5%, would yield a 6.5-7% up-front return even prior to the accumulation of tax-free capitalized interest during your years of employment and prior to taking a withdrawal.

457b

Basics: Like the 403(b), 457b plans are tax-deferred retirement plans, but they are limited to state and local government agencies or tax-exempt organizations as classified by the IRS [3]. The same rules as in 401(a) plans apply for withdrawals.

Tax advantages: These plans are offered by some health systems and allow you to put away the same dollar limits imposed by a 403(b) plan. When offered together with a 403(b) plan, individuals under 50 can cumulatively set aside $46,000 annually, while those over 50 may set aside up to $61,000. In practice, if you were to set aside $61,000 in one year, your take home salary would only be reduced by $36,600 to $42,700 per year (based on a 30-40% annual tax burden). Of course, the secondary gain would be that your retirement account would be earning tax-free capitalized interest on that $61,000 as well.

Some people are leery of investing through their employer, as they are not certain how long they will be staying with the organization and are concerned about a perceived lack of portability and the number of investment options. It is important to note that you may continue to hold monies in these plans even after leaving your place of employment. However, you are always eligible to roll over the funds into a traditional IRA with the same investment firm or a different one of your choosing, all while maintaining their tax-free status. It is important to remember that large organizations negotiate extremely low operational expense rates for their plans (often below 0.5%). In contrast, individually invested monies in the same exact investment tool such as a mutual fund have a much higher expense ratio (often around 1%). Therefore, it is often financially worthwhile to maintain funds through your prior employer’s retirement accounts if you are satisfied with the allocations in which they are invested.

In the end, financial planning is a personal decision, and how much and with whom you choose to invest should be made by carefully reviewing the fine print associated with each investment.